Joining Cost

$0.00

Terms

Free

Trial Available

No

Payment Method(s)

Bank Wire

Service Fee

Variable

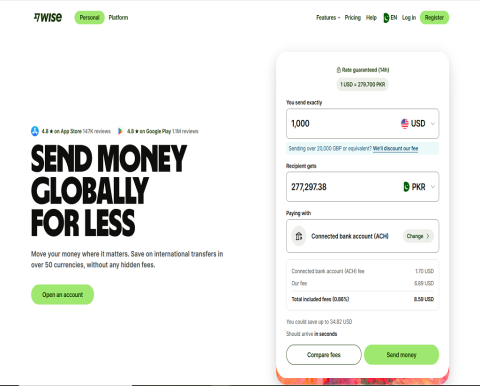

Wise, formerly known as TransferWise, is an online financial services platform that facilitates international money transfers and multi-currency accounts for individuals and businesses. It aims to offer faster, more affordable, and transparent cross-border transactions compared to traditional banks.

Features

- Multi-Currency Accounts: Hold, send, and receive funds in over 40 currencies with local bank details for major currencies.

- International Money Transfers: Send money abroad at competitive exchange rates with low, transparent fees.

- Wise Debit Card: Spend globally with a debit card linked to your multi-currency account, minimizing foreign transaction fees.

- Business Tools: Access features like automated invoicing, expense tracking, and integrations with accounting software such as QuickBooks and Xero.

Pros

- Cost-Effective: Lower fees and favorable exchange rates compared to traditional banks.

- Speed: Many transfers are completed instantly or within a few hours.

- Transparency: No hidden fees, with all charges and exchange rates clearly displayed upfront.

- User-Friendly Interface: Intuitive platform accessible via web and mobile apps.

Cons

- Limited Cash Handling: Does not support cash deposits or withdrawals; operates entirely online.

- No Credit Facilities: Lacks services like loans or credit cards.

- Geographic Restrictions: Some features may not be available in certain countries.

Free Plan Details

Opening a Wise account is free for both personal and business users, with no monthly maintenance fees. Users pay per transaction, with fees varying based on the service and currency involved.